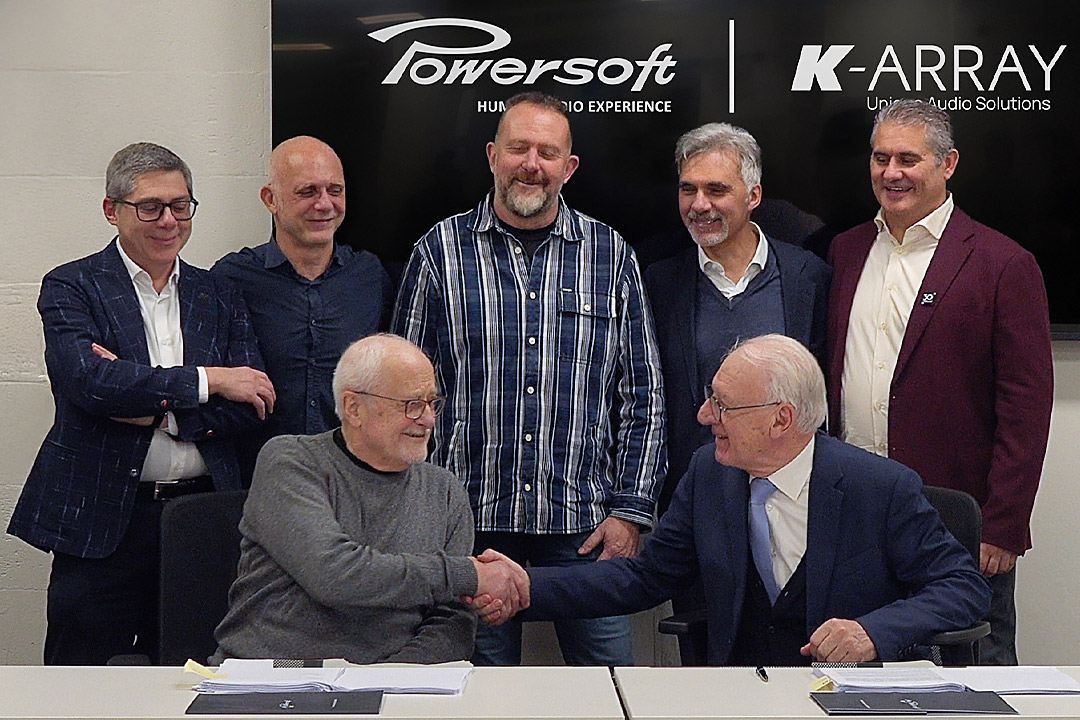

Powersoft S.p.A. (“Powersoft”), at the head of a technology group (“Powersoft Group”) operating worldwide in pro-Audio systems and listed on Euronext Growth Milan, announces the signing February 20th 2025, of a binding investment agreement (the “Agreement”) to acquire from H.P. Sound Equipment S.p.A. (“HP Sound” or the “Seller”) 51% of the share capital of K-array S.r.l. (“K-array” or the “Company”), specialized in the design and manufacture of innovative high-performance, compact design audio systems for a wide range of applications (the “Transaction”).

The Agreement also envisages the mutual granting of call and put options in favor of Powersoft and HP Sound, respectively, on the remaining 49% of K-array’s share capital. The closing of the transaction is, to date, expected by March 2025.

Luca Lastrucci, CEO of Powersoft: “We are excited to announce this acquisition, a significant strategic step for our company and the professional audio market. This transaction arises from a successful partnership between two companies that have been collaborating for many years now, with a strong territorial proximity and sharing a creative and innovative spirit, both convinced of the potential to create important product and technological synergies.

We plan to enrich our portfolio with cutting-edge products, leveraging the expertise and resources of K-array to develop new integrated audio solutions for an ever-evolving market. The synergy between Powersoft and K-array is set to generate significant results in technological innovation, allowing us to strengthen our presence in the segments where we already operate while also expanding into new areas. We can’t wait to start working with K-array to set new and even higher standards of excellence”.

Alessandro Tatini, Chairman and CEO of K-array: “Massimo Ferrati (CEO and co-founder) and I decided on this strategic step to integrate our company into a solid and constantly growing group like Powersoft. Our intention is to empower our resources, now over 100 and among the most qualified on the market, for a promising future filled with opportunities and success. In addition to growth in numbers, the goal is to strengthen a solid and cohesive foundation capable of tackling future challenges with greater resilience and determination. Our team has been integral to our growth journey, and we believe it is our responsibility to provide them with an even more ambitious vision for our project.

We have been collaborating with Powersoft since the beginning, and beyond being neighbors and sharing an identity deeply rooted locally yet globally oriented, we are united by a strong passion for technology and sound. Their innovations have always been an essential part of our work, making it obvious to realize that joining forces could add significant value to the growth that, in recent years, has been in double digits, bringing us immense satisfaction. We are confident that this partnership will allow us to achieve incredible results in synergy. We are excited and eager to unleash our full creativity and potential”.

Overview of K-array

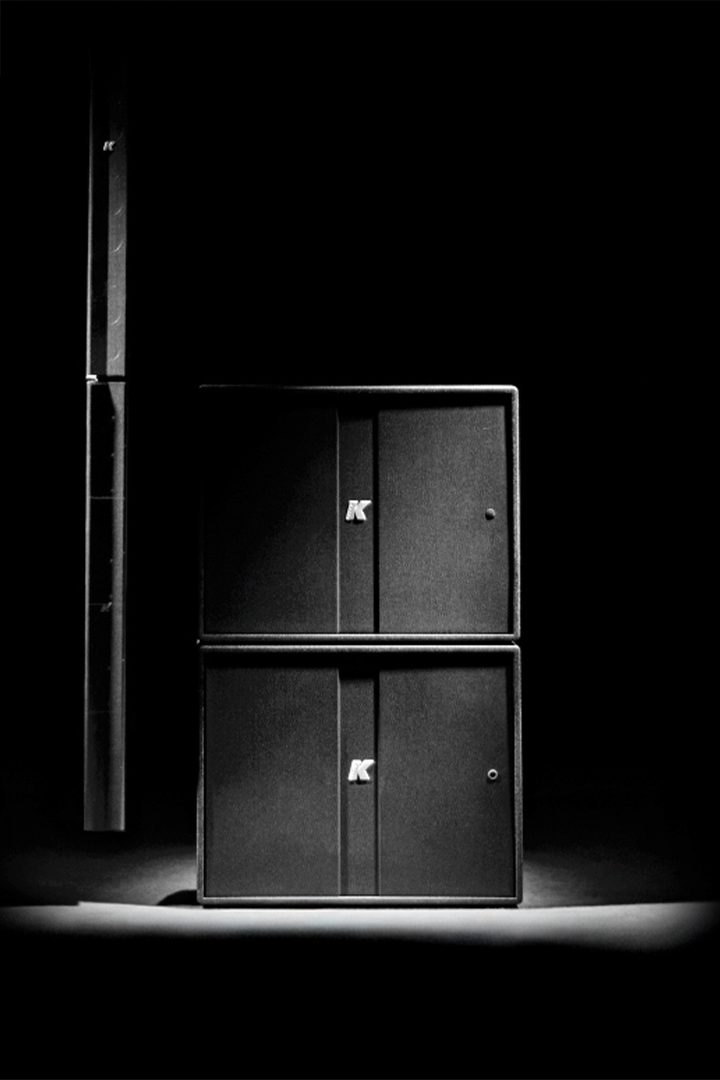

K-array, founded in 2005 and headquartered in Scarperia e San Piero (Florence), is active in the design and manufacture of innovative high-performance, compact design audio systems for a wide range of applications.

The Company, with over 100 highly qualified resources, operates primarily through 3 brands targeting different market segments: K-array, the Company’s main brand focused on audio professionals, K-Gear, dedicated to traditional and more affordable audio solutions, and K-Scape, specializing in high-quality audio and lighting systems that combine sound and lighting excellence with sophisticated design.

K-array offers a comprehensive portfolio of innovative, ultra-compact, high-performance audio and speaker systems for small, medium, and large applications, including touring, events, installations, transportation, and broadcast. Specifically, it manufactures and installs integrated solutions that include acoustic speakers, amplifiers, lighting, and accessory products such as microphones and earphones.

K-array’s share capital is currently 100% owned by HP Sound, in turn owned by K-array’s founders and Management, specifically 53.7% by Gioia S.r.l. and 28.3% by Massimo Ferrati.

K-array’s revenue at December 31, 2023 amounted to approximately Euro 19.0 million, with a reported EBITDA of approximately Euro 3.7 million. Based on the preliminary results at December 31, 2024, K-array expects revenue of approximately Euro 22.1 million (up more than 16% versus the prior year) and EBITDA of approximately Euro 6.6 million (+76%).

The K-array Acquisition Transaction is fully aligned with Powersoft Group’s strategic development plan, which aims to strengthen its presence in the pro-Audio sector through both organic growth and acquisitions, as outlined since the IPO.

It also represents the logical development of a long-established “supplier-customer” partnership between two companies that share common values: technological innovation, excellence, creativity, design, customer focus, and product quality. The goal is to leverage their complementary strengths, boosting competitiveness and fostering growth, while preserving their distinct identities and operational autonomy within a shared growth plan. Currently, Powersoft is set to continue its mission as a global technology provider, while K-array will maintain its unique positioning in the high-end audio speaker industry.

The acquisition is also part of Powersoft’s growth strategy to transform the Group from a Product Company to a Solution Provider, with a primary focus on the transportation and automotive sectors, where technological innovation, efficiency, and the reliability of audio systems play a key role.

Mention should be made in this regard of the recent technology partnership signed with Ferrari S.p.A., which marked Powersoft’s entry into the supercar industry, establishing a remarkable reference in the automotive sector.

The acquisition of K-array also represents a significant dimensional leap for Powersoft Group, which, based on the operating-financial figures from the financial statements at December 31, 2023, achieves an estimated pro-forma aggregate turnover of approximately Euro 88 million, with an estimated pro-forma EBITDA nearing Euro 24 million, counting on approximately 300 professionals, among the most experienced in the industry.

This transaction creates a leading group in the professional audio industry on an international scale, leveraging a wide range of products, technological expertise, and the innovative approach of two highly complementary companies. The combination of the two companies is expected to drive a potential increase in volume, with positive impacts on margins, while maintaining strong financial health and cash flow.

The combination will also enable the prioritization of revenue synergies through enhanced product diversification, expanded target markets, and greater geographical reach. Additionally, the collaboration between the R&D teams of both companies will accelerate the development of next-generation audio systems, in line with the latest market trends, especially for new transducer applications.

The price for the acquisition of the K-array Stake (the “Stake Price”) is based on an Enterprise Value of 100% of K-array equal to Euro 50 million (determined using methodologies typically employed in similar transactions involving industrial companies) and a net financial position of K-array, as defined in the Agreement (the “NFP”), estimated at the closing date and subject to an adjustment procedure in line with market practice.

As of the date of the signing of the Agreement, therefore, the Stake Price is Euro 25.5 million assuming a neutral net financial position of K-array, the latter, however, will be subsequently estimated at the date of the closing and will be subject to a post-closing adjustment procedure provided for in the Agreement.

More information on the Powersoft website and on the K-Array website